Maybe this is common knowledge, and if not, I seriously doubt I am the first to talk about this subject, but there is a growing housing issue that seems to not be discussed.

What is being discussed is that the US has a housing, supply deficit that is causing an increase in home prices and rental prices. This has been going on for some time now, far before the pandemic, extending to the Great Recession where building and investment has never really recovered. But this isn't really the problem, as I see it. What I see as the problem isn't really being discussed.

Before getting into the issue, I want to explain the past because it is important to understand the problem. In the past, land/homes weren't investments; they were depreciating assets or even a liability. Why? People had little incentive to buy an old home when they could build a new home. Land and building homes were cheap, so like a car, no one wanted to pay retail value or more for an old car. Most people who buy a car today pay a certain amount, and despite improvements and maintenance, the car will depreciate. With exception to rare and valuable cars, most cars depreciate. Similarly, homes were a depreciable asset, but unlike a car, they weren't made obsolete so quickly, and the improvements and maintenance were far better to homes than cars, and for that reason, home prices stayed fairly flat.

With that said, homes were still a liability more than an asset. Most people who mortgaged a home saw little to no appreciation on the home, yet they had to pay interest on their property, which means a home was a net loss over their lives, relative to inflation. They may have bought a home for $100k with 20% down and sold it for $100k, again, relative to inflation, but they may have paid 5-20% on the loan, so that could be anywhere from $80k-$400k down in interest payments. Owning a home was not a way of building wealth; it was a sign of wealth, or at least, it showed that someone could afford to buy at the expense of what was more practical--renting and investing in the stock market. It was more of a luxury. It really was part of the American dream to own. It meant someone made it.

https://www.loanatik.com/827-2/

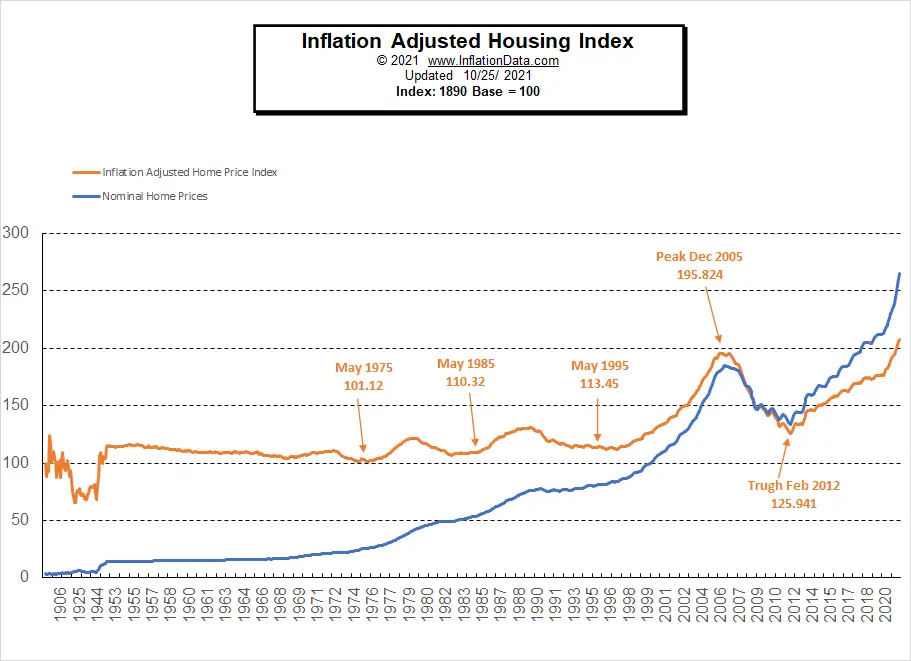

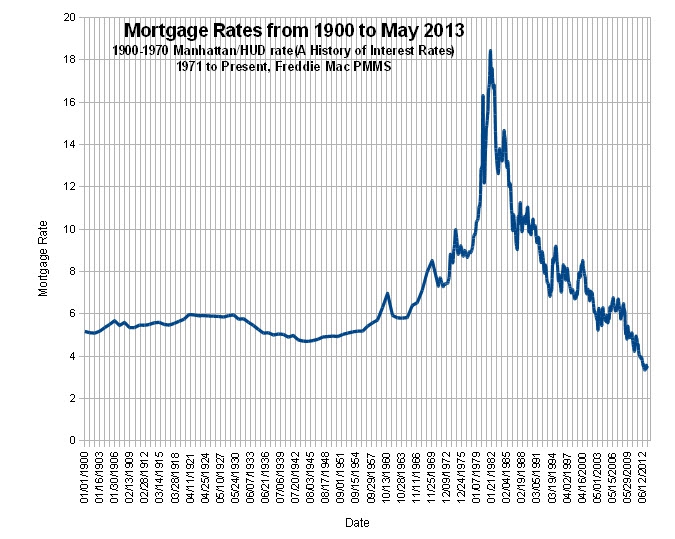

What we see below is average home prices relative to inflation were fairly flat for a long time and so was mortgage rates. Then there was little fluctuations and then things went to hell. Mortgage rates increased in response to massive inflation in the late 70's, and as you can see, we are in another round of high inflation now. This is because we had a pandemic, wages are up, demand is up, supply chains are still tight, corporations want to recoup losses from the pandemic and from wages because despite paying people more, they still need their 8-10% growth, so they are spiking prices, and in response, the fed has increased mortgage rates. How far will it go up, and what will that do to the housing market?

The other thing to note in the first graph is how we saw a housing balloon that culminated in the housing burst in 2008 resulting in the Great Recession. This was stemmed by high-risk mortgages and something else that I'll discuss in a second. For the most part, we have regulations against high-risk lending. We aren't doing crazy ARM loans or loaning to high-risk bowers. These were people that were paying a higher rate with poor credit with little down and at a high percentage of their income, and yet, here we are at the same point we were at before with home prices out of control, and this is the problem and my point:

homes are being used as investments when that isn't sustainable.

As I mentioned before, homes were not investments. If someone paid cash, they probably saw that investment stay flat or ever so slightly appreciate, but everyone else who took out a mortgage most likely saw their home being a depreciable asset. The only people making money on homes were people who were investing in real-estate for the means of buying to rent to build passive income, but that is really a separate issue (even if we could talk about how foreign investments in US housing is influencing the market, or how AirBnB has altered the investment market, and exacerbated a problem). Somewhere along the way, homes became an appreciable asset--an investment. While renting and investing can still prove to be better than buying, as it once was, the average rate of return on a home is near or higher than the rate of return on a standard mutual fund, so it has become one of the best ways someone can generate wealth. Outside of someone selling and buying multiple times in their life, incuring expenses and realtor fees, it is a sound investment, yet this is the paradox:

if home prices are investments then they necessarily have to grow faster than the rate of inflation, yet that also necessarily means homes become less and less affordable relative to the rate of inflation of wages.

If the average rate of inflation was 3.5%, for instance, and the average rate of return for a home was 8.5-10%, and say we take this to some arbitrary point in infinity, then there would become such a disparity because housing inflation outmatches wage inflation that the average home is $50 million by today's standards. The only way a home becomes affordable is if we also saw living inflation where more and more people lived in progressively smaller and smaller dwellings, such that the single room apartment that is $50 million also has 12,500 residents each paying $4k/month or 87% of their $55k average salary, before taxes. Obviously, this sounds ridiculous, but then again, when you think about it, so does the concept of homes being investments. It is a paradox. It is entirely unsustainable to have residences for the masses be investments that appreciate higher than the wages of the people that need to afford them, whether that is to buy-to-live or buy-to-rent because the investor needs to be able to recuperate their investment by renting at a profit. Something has got to give.

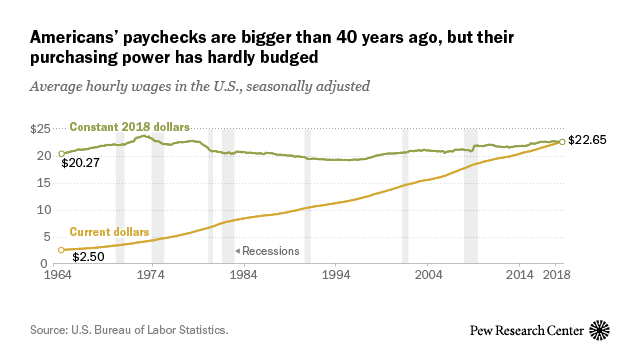

Some people will say that wages will just increase, such that, people have more buying power today relative to tomorrow. We have cars and take trips where we once all were on horseback. Third world countries modernize and people can afford more, but this just hasn't been the case. Wages have been stagnant relative to inflation. Some goods are cheaper due to economy of scale, innovation and other factors, but buying power is relatively flat. We kind of know this because we talk about the high cost of cars on this forum all the time. Sure, a Golf GTI would destroy a Ferrari from the past, but an entry level sports cars seems to get more and more out of reach relative to the average income. This is true for buying a home. While interest rates have been higher, the idea of owning is far more impractical now than it has been at many points in the last century.

I don't know if the housing market will implode, regardless of the lack of high-risk loans. Maybe people are still over-extending themselves on what they can truly afford, or maybe investors are over-extending themselves by taking on too much liability and banking on a reliable market with stable renters. Maybe if we hadn't had foreclosure and eviction protections, we would have seen the housing bubble burst, but again, something has got to give. Whether it is an implosion, a recession, or a housing recession, or what, this is currently unsustainable. I don't know if it can persist for five years or fifty or five hundred years. I don't know if it will rise and fall in waves, but surely, this housing issue is eventually going to taper off or cause a crisis in the market or in homelessness or in civil unrest.

If I am way off, please correct me. I really haven't read a whole lot of discussion on the lack of sustainability of the housing market, as an investment, but I fear this will be a real problem. Indirectly, many people don't invest and save enough in IRAs, roth IRAs, 401Ks, Bitcoin, or whatever, as it pertains to retirement. Many people sink a lot of their investments into a single asset--their home, and many rely on social security and having their home paid off to be enough, or they plan on that and some savings after selling and downsizing to a smaller home. Maybe that won't be possible. It is a paradox worth considering.